Emerging Markets and Fintech: Africa’s Big Leap Forward

Across emerging markets, fintech is more than just a buzzword - it’s a lifeline. Africa with its blend of rapid digital transformation and underserved populations, is leading this charge. While millions across the region remain excluded from formal financial services, several innovative ventures are stepping up to fill the gaps. Their efforts are not only reshaping Africa’s financial landscape but providing ground for solutions that could serve as models for other regions.

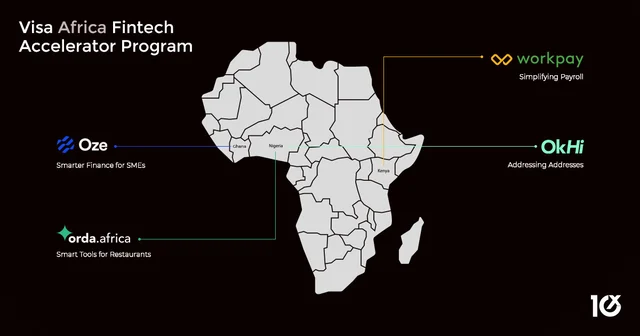

One of the most prominent examples of this shift is Visa’s recent collaboration with four African fintech startups. These partnerships are more than just financial investments - they are catalysts for change targeting critical gaps in the financial ecosystem.

The Big Picture: Visa’s Focus on Financial Inclusion

Visa’s recent support for four African fintech startups is rooted in its broader commitment to financial inclusion across emerging markets. The company’s Africa Fintech Accelerator is not merely an incubator - it’s a launchpad for transforming innovative ideas into scalable solutions. Since its inception, the program has accelerated 45 startups, equipping them with mentorship, training and investor networks.

Here’s a closer look at these four standout ventures that graduated from the inaugural cohort of its Visa Africa Fintech Accelerator program:

Oze, based in Ghana, has developed a digital tool for small businesses to manage financial records and gain access to credit, offering solutions that go beyond typical fintech.

Workpay, Kenya based HR tech firm, offers a payroll and employee management system that’s helping African businesses streamline HR processes and improve workforce efficiency.

OkHi, based in Nigeria, addresses the lack of verifiable addresses, which often limits access to services. Their digital address system is helping businesses and customers connect more effectively.

ORDA, a cloud-based restaurant software company provides solutions to help restaurants manage inventory, orders, and finances, easing the operational burden for thousands of businesses.

These companies are not only addressing local problems—they’re creating solutions with the potential to inspire similar innovations in other regions.

More Than Money: The Value of Visa’s Accelerator Program

The Visa Africa Fintech Accelerator offers more than just funding. It’s a comprehensive ecosystem of support designed to enable startups to scale effectively. By providing access to mentorship, funding opportunities, and critical industry connections, Visa ensures these ventures are equipped to tackle systemic issues in underserved economies.

As Godfrey Sullivan, Visa’s Senior VP of Products, Partnerships, and Digital Solutions, aptly puts it, "Visa’s support is helping these entrepreneurs fuel a new era of innovation across Africa. By enabling access to secure and efficient payments, we can drive real change and help build a connected future."

This approach reflects a broader strategy applicable across emerging markets—collaborating with local innovators to create solutions tailored to unique needs while leveraging global expertise.

A Ripple Effect: Fintech’s Impact Across Emerging Markets

The impact of these efforts extends far beyond the startups themselves. By fostering a network of collaboration among investors, innovators and communities, Visa is contributing to a thriving fintech ecosystem that benefits consumers, businesses and economies alike.

For Africa, this means breaking down barriers to financial access, but the lessons learned here have the potential to inform strategies in other parts of the world. The combination of the local insights and global resources is proving to be a winning formula for tackling systematic financial challenges in emerging economies.

The Future of Fintech: A Blueprint for Emerging Market

What does the future hold for fintech in emerging markets like Africa? With investments flowing in and a growing pool of local talent, the potential for digital financial services to transform lives has never been greater. Companies like Oze, Workpay, OkHi, and ORDA are just the beginning of this journey.

For Africa and beyond, Visa’s investment underscores a larger narrative—one where financial services are accessible to all, not just the privileged few. By addressing local challenges with innovative solutions, these efforts are shaping a financially inclusive future for millions.

As Paul Kimani, Co-Founder of Workpay, summed up: “We are happy to have Visa in our corner. As a trusted leader in digital payments, Visa’s support pushes us toward our goal of delivering innovative solutions and streamlining backend processes for all.”

For Africa and other emerging markets, this is a win-win. It’s a story of resilience, innovation, and hope—and it’s only the beginning.