How Have Seasonal Trends Impacted UAE Gift Spending?

Flowwow, a popular gifting marketplace for local brands across more than 30 countries, has teamed up with Admitad, a partnership marketing platform, to share some fascinating insights from their latest e-commerce market research focusing on the Middle East and North Africa (MENA) region for the first half of 2024.

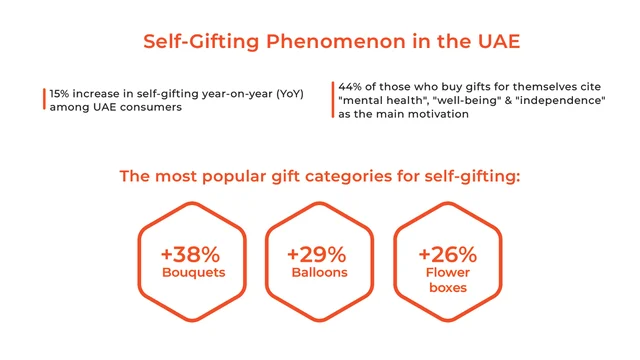

One of the most interesting trends they've uncovered is the rise in self-gifting among UAE consumers. In fact, Flowwow saw a 15 percent year-on-year increase in people buying gifts for themselves. It seems there's a shift happening in the UAE's consumer culture, with more people treating themselves as a way to take care of their mental health, well-being, and to express their independence. The most popular self-gifting items were custom bouquets, which jumped by 38 percent, followed by balloons at 29 percent, and flower boxes at 26 percent. Handmade chocolates and bento cakes were less favoured.

Flowwow's experts think this trend reflects how people are finding ways to reward themselves for their hard work and achievements, or simply to boost their mood. It's also about showing independence and financial stability since these gifts are all about personal choice and preferences.

When it comes to the broader e-commerce scene, Saudi Arabia, the UAE, and Algeria are really leading the way. The UAE, in particular, remains a super active market, with online orders up by 6 percent and gross merchandise value (GMV) growing by 12 percent in the first half of 2024 compared to the same period last year. The average transaction value in the UAE has risen too, from AED 344 to AED 433.

Saudi Arabia took the top spot in the region with the highest order growth, soaring over 20 percent, and sales volume shot up by more than 25 percent. Morocco also saw a significant GMV growth of 23 percent, closely trailing the leaders.

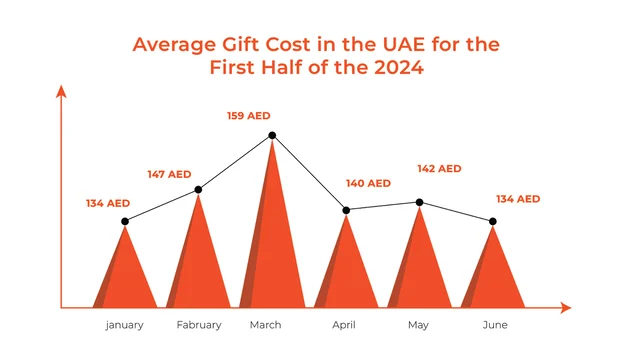

Seasonal trends played a big role too. February, March, and April were particularly busy due to Valentine’s Day, Ramadan, and Eid Al Fitr. Flowwow reported a massive 90 percent increase in purchases during this period, with February being the standout month thanks to Valentine’s Day, driving an 84 percent increase in orders compared to January. March, coinciding with the start of Ramadan, also saw a peak in activity, though it did see a 25 percent dip from February, likely due to discounts and promotions.

Average gift spending in the UAE showed some interesting fluctuations in the first half of 2024. January saw a 9.7 percent increase in spending compared to February, and this upward trend continued into March, peaking at 159 AED. However, April saw a sharp decline of 11.9 percent, with a slight recovery in May before falling again by 5.5 percent in June.

Flowwow's CEO and co-founder, Slava Bogdan, highlighted the flourishing e-commerce landscape in the UAE and the wider MENA region, driven by the rise of mobile commerce, technological advancements, and a growing demand for convenience and same-day delivery. He emphasised that this positive trend is likely to continue as companies increasingly leverage technology and consumer data to offer more personalised and seamless shopping experiences.

Speaking of mobile commerce, it's on the rise everywhere, especially in KSA, where mobile orders now make up over 60 percent of purchases. The UAE is also strong in this area, with over 50 percent of purchases made via smartphones. Turkey, however, has the lowest mobile order share in the region, below 20 percent.

Anna Gidirim, CEO of Admitad, noted that the growth in e-commerce across the MENA region is a clear indicator of the expanding appetite of online shoppers. The numbers show a significant increase in both the volume and value of transactions, driven by the region’s vibrant holiday calendar and the continued shift towards mobile commerce.

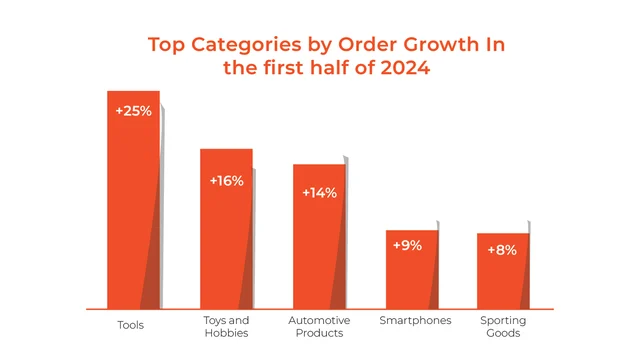

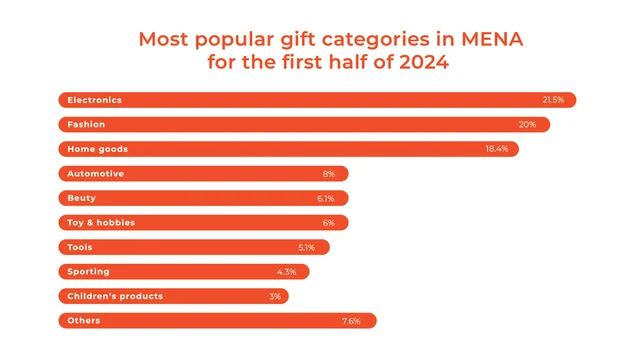

When it comes to what people are buying, electronics, fashion, home goods, and automotive products topped the list in the MENA region. The "Tools" category saw the highest order growth at 25 percent, followed by "Toys and Hobbies" at 16 percent, and "Automotive and Motorcycle Products" at 14 percent.

Looking ahead, the e-commerce sector in the Middle East is expected to keep booming, with estimates suggesting it could reach a market volume of US$50 billion by 2025. The UAE, in particular, is projected to see its e-commerce market grow from AED 27.5 billion in 2023 to over AED 48.8 billion by 2028. This shows just how much potential there is in the region as e-commerce continues to evolve and cater to the preferences of a young, tech-savvy population.